how to get help with delinquent property taxes

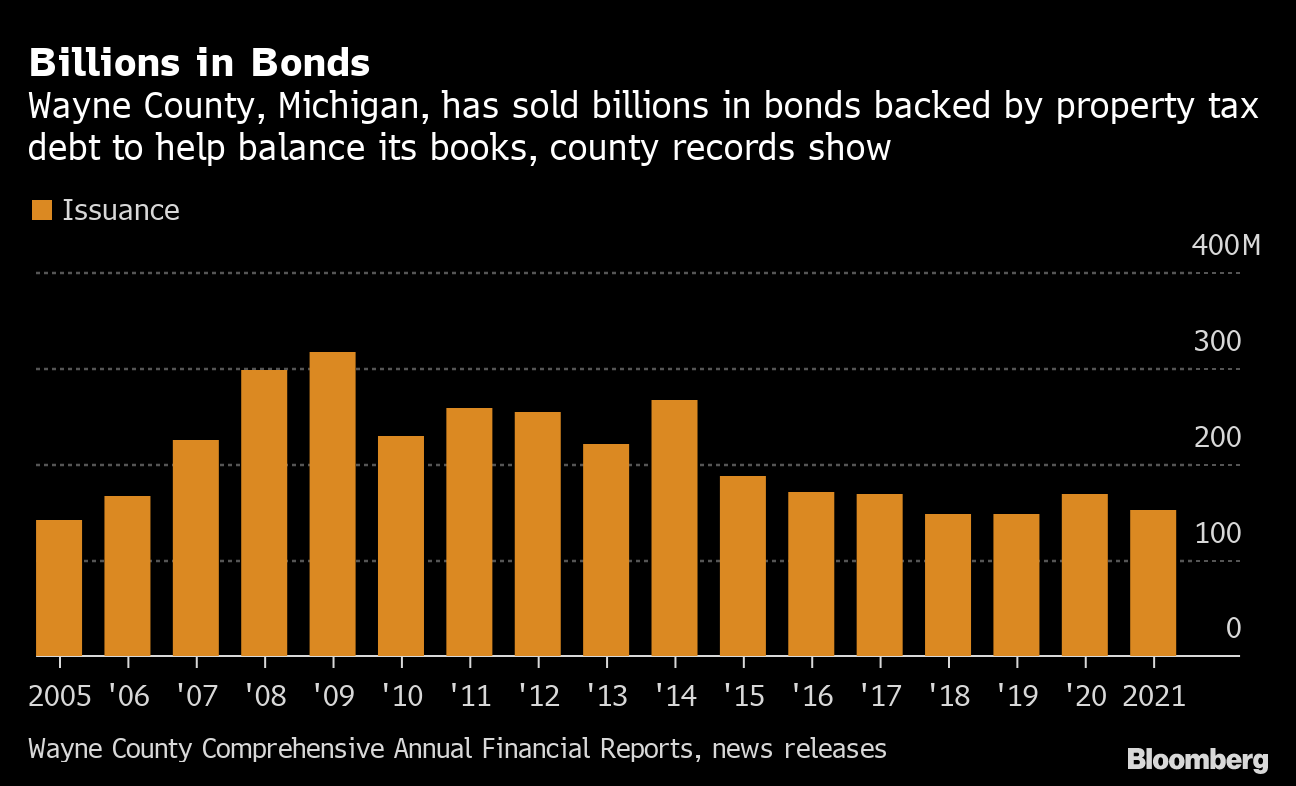

Once your price quote is processed it will be emailed to you. Essentially if the property tax bill goes unpaid the county can sell a tax lien certificate to reimburse the government for the lost payment.

Advertising Delinquent Property Beaufort Treasurer

Texas Property Tax Assistance 888 743-7993 Customer Service 972 233-4929 all states.

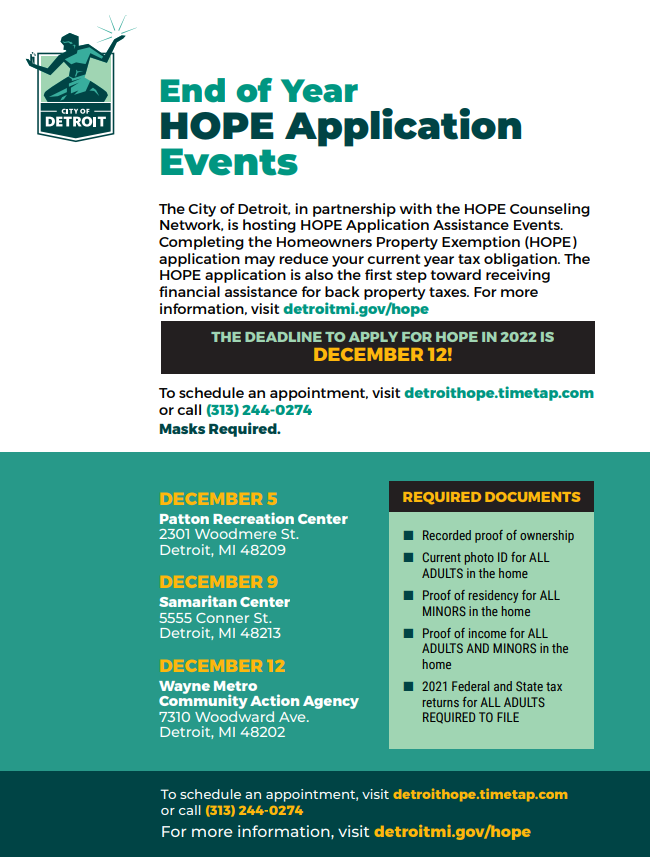

. Property taxes become due November 1 and are delinquent if not paid by April 1 of the following year at which time 3 interest and advertising. The North Carolina General Statutes NCGS provide taxing jurisdictions with several collection remedies to enforce collect delinquent taxes. The Property Tax and Interest Deferral program removes properties from the tax lien sale once an application is complete.

To apply for a PT AID payment agreement download and complete. Apply for a loan through a bank or property tax lender. Depending on the county it is also known as.

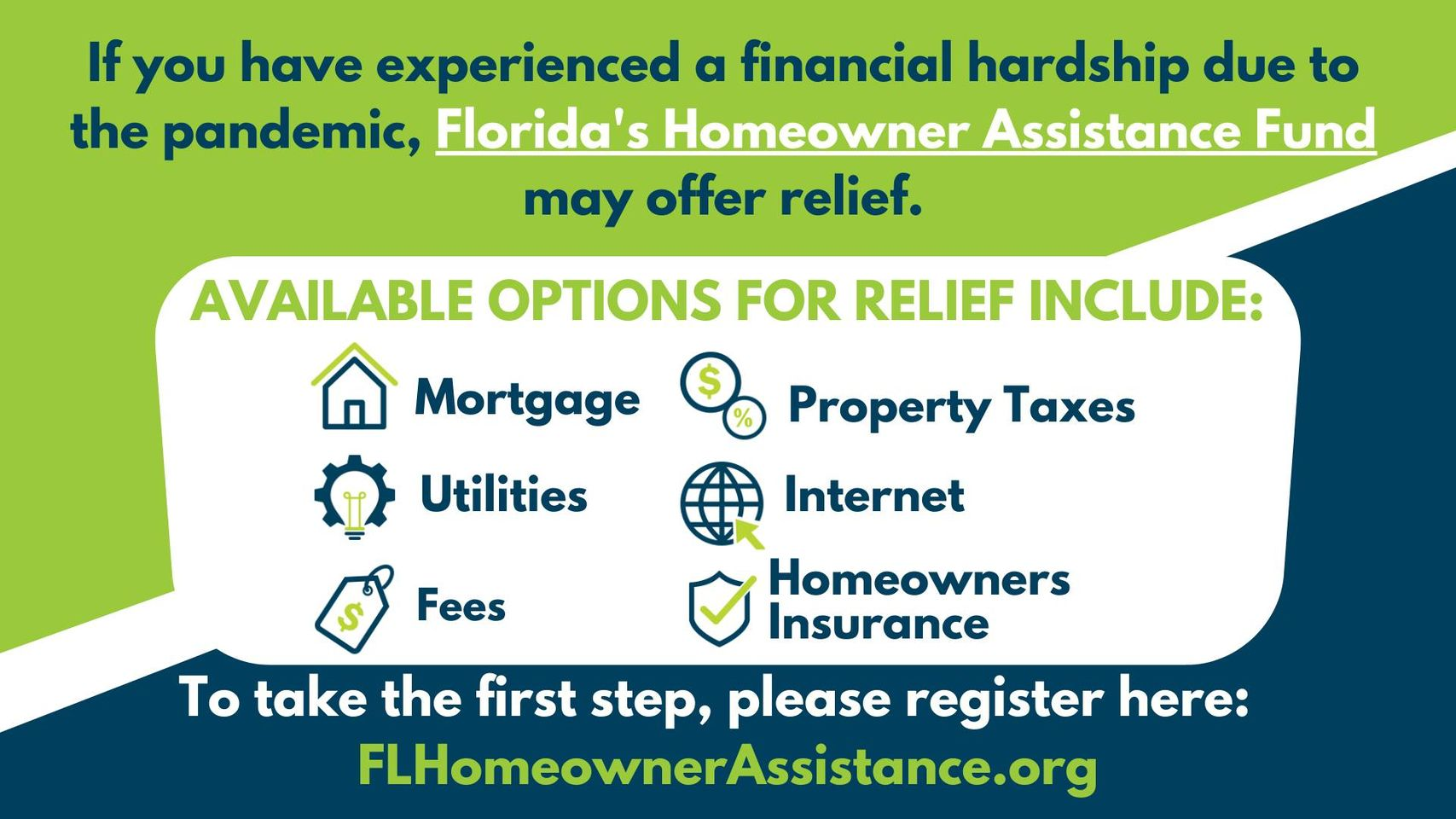

Texas Property Tax Assistance 888. You may request a price quote for state-held tax delinquent property by submitting an electronic application. Most received some CARES.

You can try cutting your spending or reorienting your life to lower. Assistance with past due property taxes will extend to mortgage-free homeowners and those whose mortgage. Or you can contact a property tax consultant or lawyer.

The tax collector or treasurer of the county creates a list of everyone who has delinquent property taxes. The program covers unpaid property taxes for eligible homeowners. Another possible source of assistance in dealing with back property taxes.

Across the great state of Texas more individuals are requesting delinquent property tax help from Tax Ease. Find out how at Tax Ease. These remedies include but are not limited to.

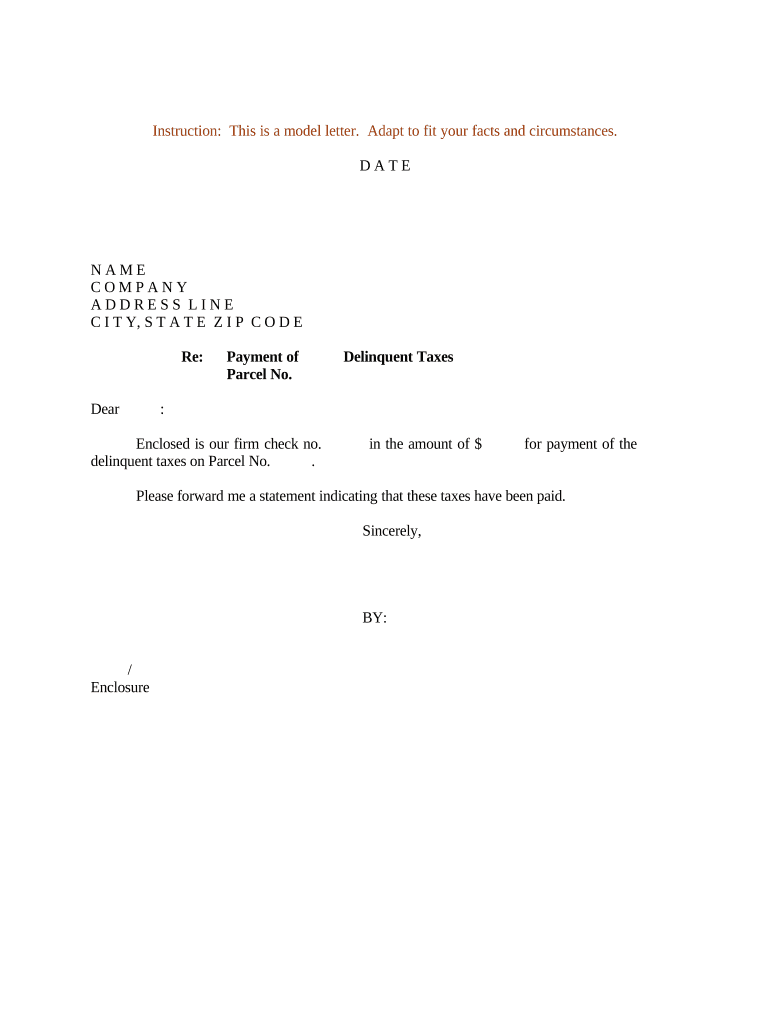

Delinquent Property Tax Information. Mail a check to the treasurers office with a letter of instruction. Determine the cost could be free or up to 500.

Texas Property Tax Assistance 888 743-7993 Customer Service 972 233. Find out how to lower your tax bill and discover other ways to get property tax help at Tax Ease. Texas Property Tax Assistance 888 743-7993 Customer Service 972 233-4929.

Learn what happens when property taxes are delinquent and find out how to get assistance right away at Tax Ease. The program now provides assistance to cover delinquent property taxes for homeowners whose mortgage payments are current or for homeowners who are mortgage. Counties auction off their tax lien.

The hearing if it is needed If the local tax assessor will not meet with the owner also note. Ask your county treasurer for the tax delinquent list. Many of these professional work on a contingency basis.

Choose the Reduce Property. Here is how it works. Get information and help with property taxes in Texas.

But you can be proactive with delinquent property tax help. Contact your county Department of Health and Human Services DHHS office to apply. Hence the name delinquent tax list.

To help property owners manage their taxes and regulate debts DoNotPay created a practical feature. Learn about paying delinquent property taxes and get assistance with a property tax loan from Tax Ease. Property tax lenders give homeowners loans specifically to pay off back taxes.

Research the lender before applying and. Open DoNotPay in a web browser. Learn more about our loans so you can pay delinquent property taxes today.

No matter what a lower assessment will help the homeowner save on their annual property tax bills. Act funds in mid-2020 which can help with property taxes. If lowering your property taxes isnt an option youll need to consider other ways to help manage those taxes.

Filing A Law Suit To Collect A Delinquent Tax Home Tax Solutions

Delinquent Property Tax Search Champaign County Clerk

Property Tax Debt Scheme Minority Families Lose Homes To Money Machine Bloomberg

How Wilmington Bankruptcy Can Help With Delinquent Property Taxes Insurance And Hoa Fees

Consumer Alert Florida Homeowner Assistance Fund

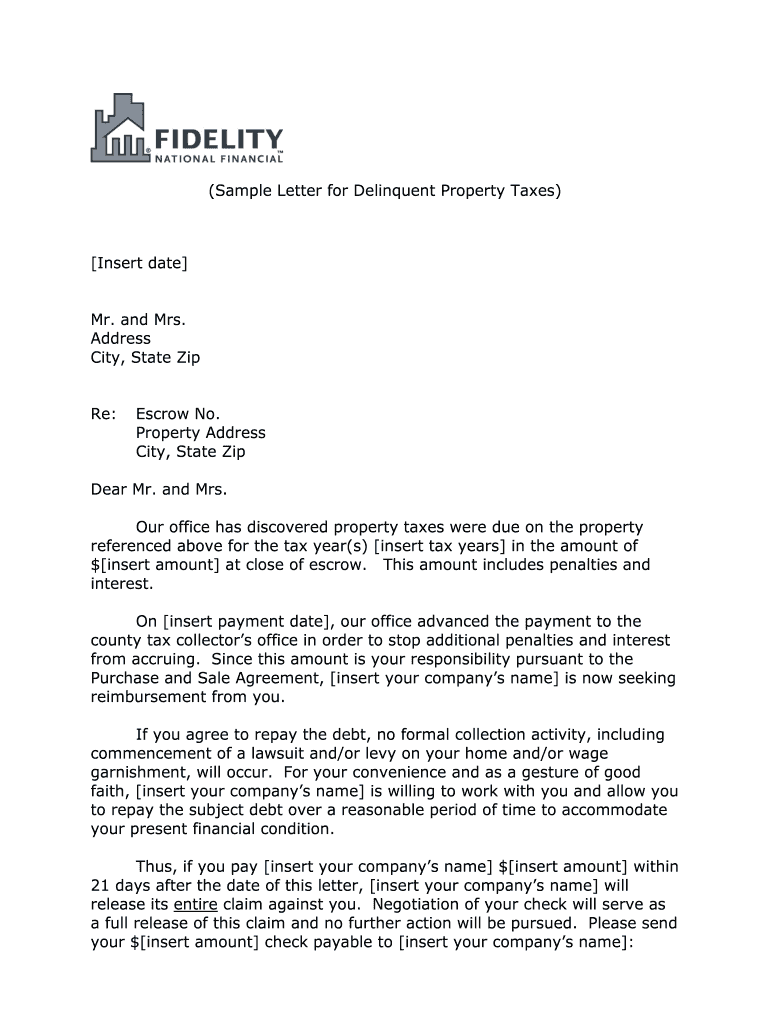

Sample Letter Taxes Fill Out Sign Online Dochub

Property Taxes Department Of Tax And Collections County Of Santa Clara

How To Find Tax Delinquent Properties In Your Area Rethority

Delinquent Property Tax Letter Samples Fill Online Printable Fillable Blank Pdffiller

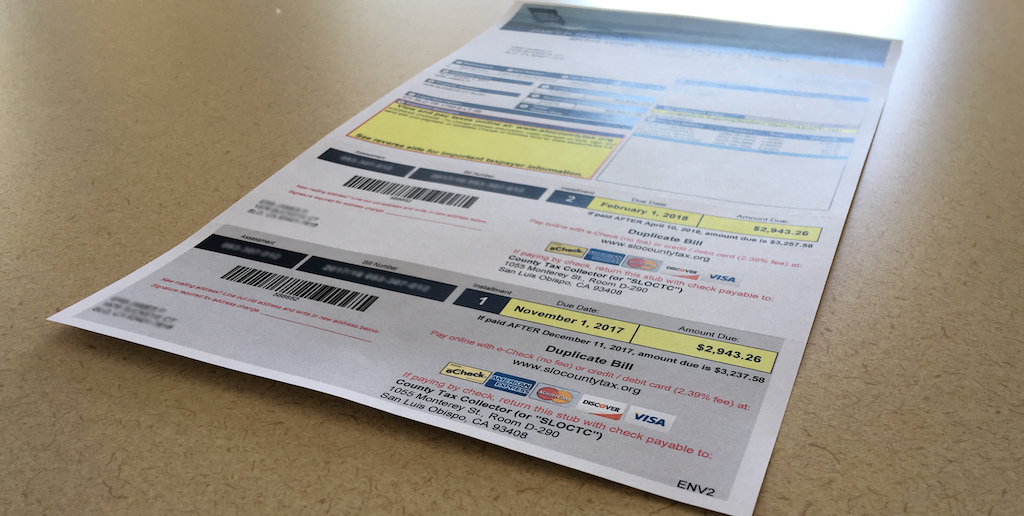

Personal Property Delinquent Tax Bill

How To Get Delinquent Property Tax Penalties Waived Update State Covid Waiver Program Has Ended County Of San Luis Obispo

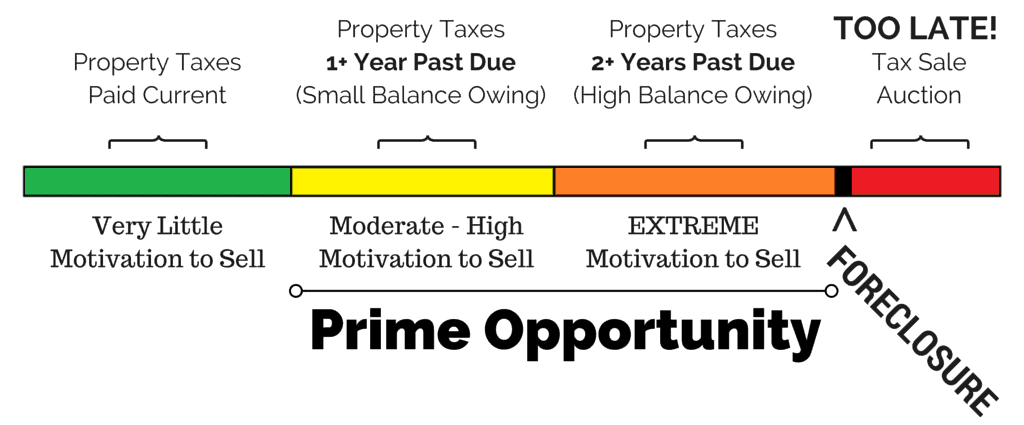

Everything You Need To Know About Getting Your County S Delinquent Tax List Retipster

How To Check For Property Back Taxes And Liens For Free In 2020 Compass Land Usa

Foreclosure Counseling Southwest Solutionssouthwest Solutions

Dougherty County Contracting With Gts To Assist With Delinquent Property Tax Process Wfxl

Texas Homeowners Assistance Grants For Delinquent Property Taxes Late Mortgage Payments City Of Odem Texas Incorporated In 1903

Tarrant County Program Aims To Help Residents With Delinquent Property Taxes Dallas Tx Patch

Tarrant County Residents Can Get Help With Delinquent Property Taxes Fort Worth Report